Betting on Purpose

Eventually, we all want to find meaning.

Some of us pursue the search through family. Some through religion. Increasingly, many people our finding purpose in their professional pursuits. Finding meaning in work is not new, of course. Teachers, Doctors, religious officials, and millions of people in the non-profit sector chose professions that center purpose in their professional career.

What is relatively new is a pathway for hundreds of millions more people to pursue purpose within the traditional for-profit economy. Organizations such as Outschool, Patagonia and Beneficial State Bank provide a platform for employees whose skills range from computer science and loan operations to clothing design to align career with purpose.

Purpose driven organizations explicitly measure success with a metric(s) other than shareholder returns. They exist to create some other change in the world, and that goal is made explicit throughout the organization, including to shareholders (in for-profit) and donors (in non-profits).

My professional goal over the next twenty-five years is to increase the purpose driven economy. More purpose driven organizations will provide customers, employees and investors with more choice in the marketplace, creating value for all by allowing for all of those constituencies to align their purchases, work, and capital with goals other than profit.

Taxonomy of Purpose Driven Economy

How do we increase purpose driven economy? First, consider the different models for building a purpose driven company within the for-profit sector. Simplifying, there are three types of purpose driven companies:

- Purpose designed organizations. These are companies that are built for the larger purpose from the start. The way the company makes money and provides value to customers fits with a larger purpose.

Examples include Tesla (decarbonization), Outschool (learning), and Pagatech (access to financial services). As these organizations sell more products or services, the non-financial metric that is the purpose of the organization advances. Over time, the capabilities of the organization grow in line with the purpose goals.

Purpose designed organizations provide high alignment between shareholders and purpose. The risk of long-term deviation between the stated purpose of the company and the financial outcome for investors is low.

As a result, corporate governance structures and third-party audits' of corporate practices are relatively less important to verify and ensure the claims of the company. In other words, it would be hard to imagine shareholders of Tesla doing well in the long term without the company successfully selling a lot of electric cars, thereby removing a lot of gasoline powered cars from the road in the process. We don't need to invest heavily in social audits or third-party certifications to verify the outcome of producing and selling millions of electric cars.

- Purpose aligned organizations. These are companies whose capabilities and brand developed are purpose aligned. Purpose here is driven not by what the company manufactures or sells, but how in it does it.

Companies like Patagonia, Allbirds, and most other B Corps fit in this category. Purpose goals advance as the company grows, but only through a continuous series of management led decisions to balance profits with purpose. Many of these organizations market to customers with their purpose goal, using their commitments to purpose as a driver of growth.

Purpose aligned organizations are positive for the world. They provide choice for consumers in many categories (such as consumer goods, financial services, even legal services) where there have been few options historically.

However, purpose aligned organizations present two significant risks. The first is greenwashing, or making claims for marketing purposes that aren't in fact material to the business goals.

Is Goldman Sachs a purpose aligned organization? In their annual Sustainability Report they make the claim that the purpose of Goldman Sachs is to "advance sustainable economic growth and financial opportunity." Does anyone really believe that?

Goldman adopts the mantle of a purpose, while its customers, shareholders, and employers more accurately know that their goal is to maximize profits within existing legal and ethical norms. In fact, should they not focus on maximizing profits, for example by suddenly giving away a material amount of money to ‘advance financial opportunity' in the world, then the Board of Trustees and shareholders would have reason to take action against the company for failing to live up to their previous commitments to shareholders.

Goldman's narrow legal tension is representative of the broader concern with purpose aligned organizations. There is a constant, irreducible tension between shareholders and purpose. Managers always must weigh whether to support the bottom line or the company purpose.

For example, many businesses in the CPG space highlight their sustainability practices. Should a manager choose packaging that is 10% more cost to reduce 10% waste? What if it is 20% or 50% more expensive? There is no clear answer. All too often, shareholders and purpose goals will be on the opposite side of such decisions, even with positive intent from all involved.

Purpose aligned organizations have a critical flaw: managers are constantly making judgement calls to determine the meaning of their purpose commitments. Unlike purpose designed organizations or purpose committed organizations (below), these companies constantly operate in a gray area. For the life of the business, managers must weigh the marketing (and personal identity, which I don't discount) benefits of incremental investments in the purpose goals, with the incremental bottom line costs of additional steps in pursuit of purpose. As the company grows and complexity increases, these tensions only increase as well.

- Purpose committed organizations. The third category of purpose driven organizations use formal governance structures to commit the organization to a path that balances purpose and profit. The organizations are setup to legally bind themselves to a subsequent balance point between shareholders and other interests. For example, the company could set aside a certain percentage of revenue or profit, a certain number of shares, to a named purpose. Or, it could codify an ongoing operational process (e.g. an artificial limit on executive pay) for the life of the business. What is important is the commitment is irrevocable, allowing customers, employees and shareholders all to understand clearly the future alignment between broader purpose and shareholder value creation.

Examples of purpose committed organizations include Beneficial State Bank (100% of the economic rights are owned by a foundation), Newman's Own (100% of profits to charity) and Vanguard (the organizational purpose is to 'take a stand for investors' and the organization is owned entirely by the shareholders).

For purpose committed organizations, the risk of greenwashing is low. The purpose goals are codified in legal documents governing the organization. This pre-commitment device intentional constrains subsequent management decisions. The organization defines the balance between purpose and shareholder concerns prior to the subsequent decision points of potential customers, employees and shareholders.

A key benefit of the model is to open up new new industries and business models to the purpose driven economy. Because alignment is created by binding corporate commitments rather than the product offering or branding of the company, any company in any industry can be purpose driven.

Purpose committed organizations aren't limited to business models that create purpose in the creation of the product or service (such as building an electric car). Any company, whether a restaurant, accounting firm, or software company, could make this type of binding commitment. And, the model allows for range of organizational commitments. Investors, employees and customers all vote with their feet as to whether the commitment matters in their relationship.

Where we are headed

Purpose committed organizations are the key to increasing the purpose driven economy. Here's how this transition is already happening:

- Information Proliferation. With everyone online, customers, employees and investors all now have much more information about organizations they may want to engage with. It simply wasn't possible twenty years ago to efficiently learn about the corporate values beyond the products we bought, perhaps even the company we worked for. Today, that information is unavoidable to many of us. Employee reviews are on sites like Glassdoor, customer reviews are presented without request through online retailers, and corporate websites invariably proclaim corporate ownership and values.

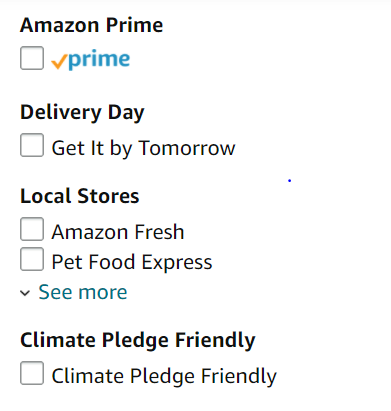

- Changing the Job to Be Done. With more information, customers, employees and investors are beginning to view purchasing, employment and investing as more than a one-dimensional commercial transaction. The product is the company. In the language of Clay Christensen, the job to be done moves from 'buy shampoo' or 'earn a living' to 'wash my hair consistent with my values' and 'find employment with purpose.' Not for all decisions, of course. Amazon isn't threatened. But if you doubt where we are headed, look at the left hand rail next time you are shopping on the world's largest online retailer:

Adding a dimension for purpose in selecting what company to support creates a long tail of businesses that are now viable. Local bookstores, environmentally supportive consumer goods, and impact investment funds are all examples of this ongoing trend. Every day, more decisions from customers, employees and investors are moving from a commercial transaction to an identity affiliation.

- Reinforcement. As entrepreneurs see a new pathway for growth by appealing to a values aligned audience, more companies will be created to segment different customer, employee and investor preferences. This is a good thing - the market responding to a new vector of customer segmentation. Value is created for all sides when a new offering provides optimizes preferences for some underserved segment of customers, employees, and investors. What are today monolithic markets become without more nuanced, with large providers still serving mass audiences, but also viable companies serving values-aligned segments in the tail.

Purpose committed organizations, rather than purpose designed or purpose aligned, will drive this change because they are flexible enough to exist in any industry, and they make a stronger claim to potential customers, employees and investors than a purpose aligned organization.

An example is my own company, Earthrise. Earthrise invests and builds purpose driven companies under a single parent company umbrella. We aren't naturally a purpose designed organization. We could claim purpose alignment with a commitment to serve only certain customers or to conduct business in accordance with certain standards. Those commitments, however, would be at risk as the business grows. As we succeed, the tension will increase to renege on promises, scale and find a way to absolve ourselves later (perhaps with a "Corporate Sustainability Report...").

Instead, Earthrise has formally adopted a commitment device to permanently tie our success to advancing a purpose other than profits. 50% of the profits, in perpetuity, are set aside for global environmental stewardship, including mitigating the effects of climate change (more on the model here). This is a binding commitment in the company charter that cannot be changed without approval of all shareholders, including the Trust that has been created to hold shares equal to 50% of the company.

Earthrise can build products, iterate on what it is selling, to whom and how, knowing that the long-term alignment between purpose (in this case environmental stewardship) and profits cannot be severed. Customers, employees and investors all know this as well, allowing for confident decisions on whether Earthrise fits their 'job to be done.'

More experimentation is needed. More innovative models within the purpose driven taxonomy (and beyond), open space for the market to find a new equilibrium between profit and purpose. With choice, I believe a significant number of customers, employees and investors will choose to reallocate, creating durable, meaningful change in our corporate landscape.

Did you like this post? In one click, please let me know